State fund becomes market player

Tuesday, March 21, 2006

ENOCH YIU and BEI HU

The National Council for Social Security Fund (NSSF) has opened an account in the local stock market's clearing house, indicating that it has successfully lobbied mainland authorities to allow it to receive shares, rather than cash, from the initial public offerings of state-owned enterprises.

Market sources say that such a major policy shift will mean the giant pension fund is in a position to boost its funding through H-share initial offerings.

Under rules introduced in 2001, all state shareholders selling stakes were required to give 10 per cent of the proceeds of new listings to the NSSF, the fund of last resort designed to plug holes in provincial social security systems.

Sources say Bank of China, due to list in Hong Kong in May, could be among the first big initial offerings to pay the NSSF in shares.

The plan still faces objections from China SAFE Investments, the bank's dominant state shareholder, which argues the NSSF had already agreed to a pre-offering investment of 10 billion yuan.

The first company to be affected by the rule will be Hunan Nonferrous Metals Corp, which launches its initial offering today and give a 3.3 per cent stake to NSSF.

Tony Espina, chairman of the Hong Kong Stockbrokers Association, said the new policy would silence mainland critics who had long complained that the listing of state-owned enterprises in Hong Kong would permit them to fall into the hands of overseas investors.

"The NSSF will be able to hold on to these stocks in the long term, receiving dividend income and the capital gains from these IPOs," Mr Espina said. "It means that H-share listings will benefit the national pension funds and the future pensioners of China."

Previously, the NSSF was paid in cash from Hong Kong offerings, allowing it to invest the proceeds only in bank deposits or bonds with low returns of just 3 per cent a year.

Big Name Bets on Small Deals

Goldman FindsGrowth on the Cheap In Hong Kong-Listed Firms

By KATE LINEBAUGHMarch 21, 2006; Page C14

HONG KONG -- Investors hunting for small China or Hong Kong plays might consider following the money. Goldman Sachs' money.

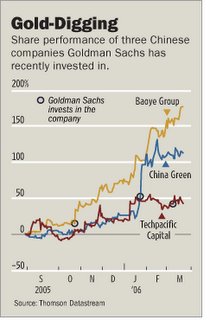

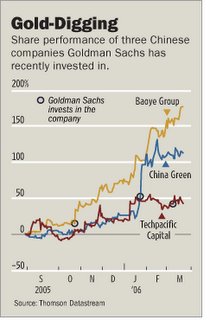

In recent months, Goldman Sachs Group Inc. has invested US$140 million in three small Hong Kong-listed companies in businesses ranging from construction to gas exploration. Buying either equity or equity-linked securities, the New York investment bank has helped fund these thinly traded and capitalized companies, which aren't in a category generally associated with one of Wall Street's premier names.

Should investors follow Goldman's lead? In Asia, the combination of low valuations and solid growth prospects can make less-recognized names a lucrative opportunity, some investors say. But many of those stocks have already performed strongly this year, thanks in part to an influx of foreign money -- such as Goldman's -- into one of the world's fastest-growing regions.

Goldman, which last week reported a 64% increase in fiscal first-quarter net income to a record $2.48 billion, is hoping that taking on more risk both for clients and on its own books will yield better returns.

"They are the first of the big names to invest in the small entrepreneurship area," says Yang Liu, a portfolio manager in Hong Kong for Atlantis Investment Management. "I think that this game has just started."

In November, Goldman bought a 17% stake in Baoye Group, a private-sector Chinese construction company based in Zhejiang province with more than 40,000 employees. With the HK$209.3 million (US$27 million) of proceeds from the sale of new shares, Baoye has begun expanding into other provinces. Last week, it announced a HK$127.7 million purchase of Hubei Construction Group.

Goldman's investment came after the stock already had roughly tripled from a public offering price of HK$1.43 a share in 2003. Still, the shares have more than doubled since Goldman's entry, closing at HK$12.75 a share yesterday. (Goldman paid HK$4.85 a share, a 7.6% discount to Baoye's market price of HK$5.25 on Nov. 3.) Since the beginning of the year, Baoye's shares have risen 59%, in line with a rally of China stocks.

In January, Goldman invested HK$312 million in China Green, a private-sector agricultural company in Fujian province, to help it finance a food-processing center in Shanghai. Goldman bought a five-year convertible bond and was paid HK$12.2 million for managing the deal.

When China Green went public in January 2004, it set a Hong Kong record, as retail investors ordered 1,600 times as many shares in the initial offering as were available. That demand spawned a 58% price jump on the first day of trading to HK$2.025, though the shares then languished and took nearly two years to reach that level again.

On Jan. 25, the day Goldman struck its deal, China Green's shares closed at HK$2.50. Since then, they have risen 45% to HK$3.625 -- well above the HK$2.655 price at which Goldman can convert the debt into equity. China Green's shares are up 69% this year.

Whether Goldman just knew a good time to get into these small China plays or whether its capital fired them up -- or both -- the investment bank's strategy is worth watching.

To be sure, Goldman has put money down in large China investments, too. Alongside its private-equity arm, Goldman invested $2.58 billion in China's biggest bank, Industrial & Commercial Bank of China.

But the two small investments, about which Goldman declined to comment, have drawn attention.

"It's just a trend for investment banks to spot out viable small- and mid-cap stocks and take a significant stake by way of equity or convertible bond," says Andy Mantel, managing director at Pacific Sun Management in Hong Kong. Mr. Mantel, who owns China Green shares, says the company trades at about seven times his forecast of 2007 earnings. He estimates sales will hit US$100 million that year. In the six months ended Oct. 31, company revenue was US$32 million.

Most investment banks have proprietary trading operations, for their own accounts, and make investments that generally aren't publicized. Because Goldman's two Hong Kong investments crossed certain thresholds, they were publicly disclosed to the city's stock exchange by the companies themselves.

For Goldman's private-equity arm, buying into obscure companies, with limited opportunities for advisory fees, isn't typical. It usually looks to leverage investments in companies into such fees when they do a deal or go public.

Many investors are looking at China in search of higher returns. And huge funds are available. Globally, private-equity funds raised US$246 billion last year, compared with US$97 billion in 2003, according to Thomson Venture Economics. Goldman is part of the trend, making investments -- and, like specialized Asian investors -- using its regional experience to find capital-hungry Hong Kong companies that have low valuations but good growth prospects.

"Most of your returns should be coming from this area," says Ms. Liu of Atlantis, "but they require tremendous expertise."

Goldman's latest deal, with Techpacific Capital this month, veered into different territory, with no China angle.

With interests from London to Japan to Louisiana, Techpacific changed into a merchant bank-cum-gas exploration company after the collapse of the technology market made its original mandate, as an incubator for technology companies, untenable. Techpacific is a holding company with an 81% stake in London-listed merchant bank, Crosby Capital Partners, which in turn owns 28% of a Japan-listed company, IB Daiwa.

To raise capital for IB Daiwa's gas-exploration projects at three Louisiana sites, Techpacific began talking to bankers to sell a bond convertible into Techpacific's shares and exchangeable into those of Crosby. That is when Goldman swooped in, offering to take the deal on its own books without a road show.

On March 6, the two parties the completed the US$75 million deal. The five-year bond is convertible into Techpacific's shares at HK$0.7665 or exchangeable into Crosby shares at 99.75 pence (US$1.75). At the time, Techpacific shares were trading at HK$0.75. Subsequently they rose to HK$0.81, but yesterday were back to HK$0.75. Goldman may have sold some of its exposure to DKR Capital Partners, a Stamford, Connecticut, hedge fund that disclosed an interest in Techpacific to Hong Kong's stock exchange. Goldman declined to comment.

Write to Kate Linebaugh at kate.linebaugh@wsj.com